Ayondo

Pros

- Regulated by FCA

- Minimum deposit is just £1

- Over ten years of history

Cons

- No Islamic accounts

- No way to view impact of individual traders you follow

- Cannot download transaction history

Min Deposit

£1, £2,000 for social tradingMax Leverage

1:200Mini Account

Bonus

Offers vary, no current offersPlatforms

- TradeHub

Withdrawal Options

- Credit and debit cards

- Bank wire transfers

Review

Introduction

Ayondo is a fintech group that offers its own trading platform and a range of trading choices, including social trading. Based in London, Ayondo also has offices in Frankfurt, Singapore, Madrid, and Zug. It is regulated by the Financial Conduct Authority (FCA) in the United Kingdom. The broker is easy to use and includes user manuals in its FAQ section to help further explain its platforms. The website is available in six languages to help appeal to international clients. Ayondo has numerous honors, including being the UK Forex Awards Winner 2017 for Best Forex Social Trading Broker.

Trading Conditions

Ayondo makes it very hard to find specifics regarding trading conditions on its website, including the leverage. Clients indicate that the platform has fast execution speeds. There are not currently any promotions or bonus, but there have been many in the past so it is worth keeping an eye out. The only types of accounts with ayondo are live or demo accounts, but resources indicate that as you trade with ayondo, your account can become a higher level with improved commissions. Professional Accounts are also available, giving you access to ayondoPRO with a leverage of up to 200:1 and 2,000 products, extra-tight spreads, a spread rebate program, and personalized service.

Products

Ayondo focuses on social trading, which lets you follow top traders and automatically copy their trades. Ayondo markets includes access to commodities, currencies, indices, and shares. There are more than 30 cryptocurrency pairs, cryptocurrencies, CFDs, precious metals, interest/bond rates, shares in major blue-chip companies, and major indices from the US, Asia, and Europe. Customers who are from Ireland or the UK can also choose to engage in spread betting. Those with Professional Accounts have access to more than 2,000 products.

Regulation

Ayondo markets Limited receives its regulation and authorization from the Financial Conduct Authority (FCA). The FCA registration number is 184333. BaFin (the German Financial Supervisory Authority) regulates and authorizes the Ayondo portfolio management GmbH. Ayondo GmbH acts as a tied agent of Ayondo markets Limited. The company number for Ayondo markets Limited is 03148972.

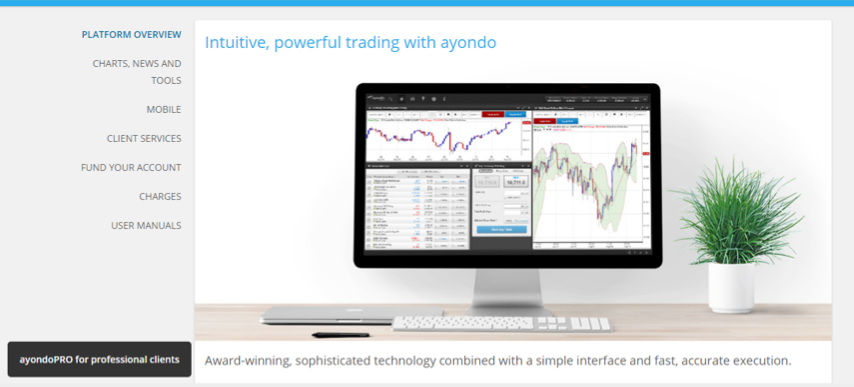

Platforms

Ayondo has its own trading platform, TradeHub, since it must incorporate social trading. The platform uses award-winning technology and has a simple interface with fast, accurate execution. The design is simple to let users focus their trading and includes filters to easily and accurately search. The platform also includes one-click trading from the charts and state-of-the-art indicators as well as charts. The platform even features free automatic, guaranteed stops and the ability to select your own margin. You can input notional amounts for the trades. There is also a mobile version available.

The TradeHub charting package includes persistent indicators, pattern recognition, 13 chart types, more than 170 studies, the ability to adjust technical indicators, customization, and more. It is browser-based so there is no need for a download. Professional clients also get a personalized guided tour of the Ayondo platform.

Mobile Trading

TradeHub is also available for smartphones and tablets, either iOS or Android. The mobile application has full functionality, including the ability to monitor positions, fund or withdraw your account, and view live streaming charts and prices.

Pricing

As a market maker, Ayondo does not charge commissions and instead makes money based on its spreads. Spreads can be highly competitive with the EUR/USD pair as low as 0.8 pips. There are overnight fees of 3% and financing charges for long positions. It is also possible that you will have to pay a follower fee, but this varies based on your Top Trader’s selected renumeration model. In this case, there may be a 25% performance fee and a 1% management fee, but you can choose a Top Trader that does not charge these fees. Ayondo passes on 100% of dividends for the UK shares plus 85% for the US shares.

Deposits & Withdrawals

There are two main options for funding your Ayondo account: using a credit/debit card or a bank wire transfer. Making a deposit via a credit or debit card does not carry a fee unless the card was issued outside the EEA, in which case there will be a transaction fee of 1.75%. It is also possible that your provider will charge a fee and cards must be 3-D secure. International bank transfers can be done with EUR, GBP, USD, DKK, SEK, SGD, or CHF. The first deposit of this type requires a transaction receipt or bank statement. Withdrawals are returned to the source of the deposit for processing within five working days.

Customer Support

Near the bottom of any page on the Ayondo website, you will see the support phone number as well as the email address, with a link to each. Or you can select “Contact” from the main navigation bar. This will give you phone numbers for social trading support and TradeHub support plus an email. The service team is on hand UK time on weekdays between 8:00 and 17:00. The trading desk has its own phone number and is open from Sunday at 22:15 to Friday at 22:15. All times are in the UK time zone. The Contact page also lists the contact information, including address, for each Ayondo office.

Research & Education

Clients get additional features, such as a regular morning briefing and regular webinars on a range of topics. There is also an extensive selection of educational articles in the Learn section of the Ayondo website. The Learn section includes user manuals, a glossary, FAQs, and guides to CFDs plus useful dates.

Noteworthy Points

As mentioned earlier, Ayondo earned the title of Best Forex Social Trading Broker from the UK Forex Awards in 2017. It also earned the title of Best Social Trading Platform at the 17th MENA FFXPO in Dubai in 2016, the title of Best Social Trading Platform from the ADVFN International Financial Awards in 2015, and a spot on the FinTech 50 list in 2013.

Ayondo also offers an affiliate program for both its Social Trading and CFD trading, allowing affiliates to refer new clients for either type of service. There is also an introducing broker program and options for white label.

Conclusion

Ayondo is a good choice for traders who want to be able to trade CFDs and engage in spread betting (if they are in the UK and Ireland) on the same platform that they use social trading. The platform’s regulation by the FCA provides confidence for users. The social trading element of Ayondo can appeal to beginners who want to hone their skills by following traders as well as experienced traders who want to increase their profits by becoming a Top Trader.

Comparison

Broker Comparison Maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.